Renaissance Technologies Trading Strategies Revealed: If you’re interested in the world of finance, hedge funds, or quantitative trading, you’ve probably heard of Renaissance Technologies, a secretive but wildly successful hedge fund known for its mind-blowing returns. Founded by mathematician Jim Simons, Renaissance Technologies has achieved unparalleled success by employing sophisticated mathematical models and data-driven trading strategies.

In this article, we will uncover some key aspects of Renaissance Technologies’ approach to trading, explore the strategies they may use, and provide insights into why their methods have remained so successful. Although the firm keeps its exact strategies under wraps, we can analyze the public information, research, and expert insights available to gain a better understanding of how they operate.

Renaissance Technologies Trading Strategies Revealed:

What is Renaissance Technologies?

Renaissance Technologies, often referred to as RenTech, is a hedge fund management firm founded in 1982 by Jim Simons, a former mathematician and codebreaker. Renaissance became famous for its unique approach to trading, using quantitative methods to analyze vast amounts of data and find patterns that can predict the market’s future movements.

The firm employs hundreds of PhDs, mathematicians, and scientists rather than traditional Wall Street analysts. This reliance on data science, mathematics, and cutting-edge technology sets Renaissance Technologies apart from many other hedge funds.

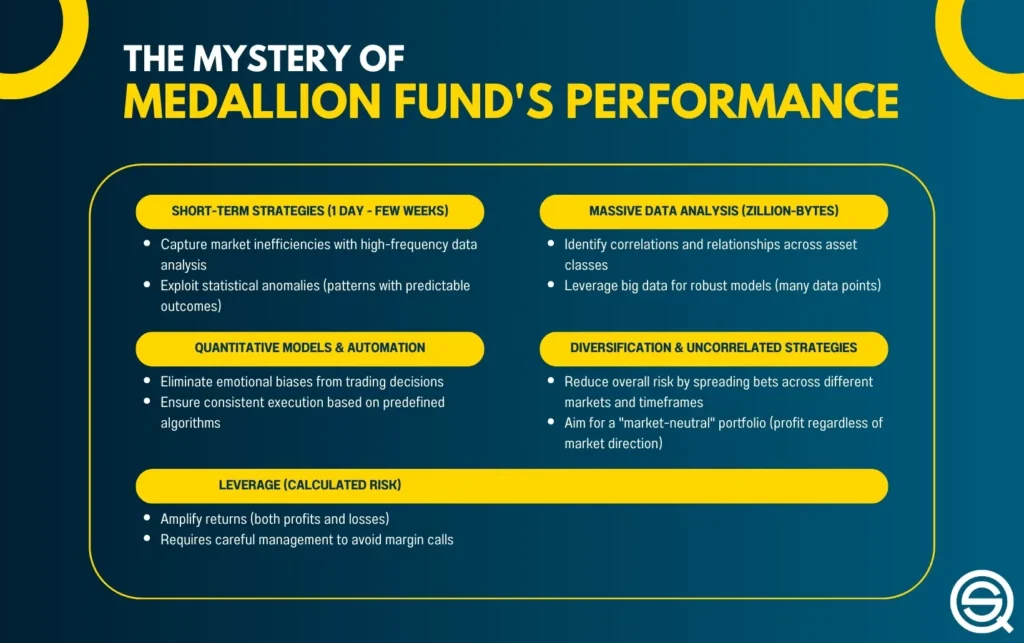

Renaissance is most famous for its Medallion Fund, which has posted remarkable average annual returns of nearly 66% before fees from 1988 to 2018. Even after taking out the hefty fees, the fund has consistently outperformed almost every other hedge fund or investment strategy in history.

The Medallion Fund: A Hedge Fund Like No Other

The Medallion Fund is Renaissance Technologies’ flagship fund and is arguably the most successful hedge fund ever. While the firm also operates other funds open to external investors, the Medallion Fund is primarily for Renaissance’s employees and insiders, making it exclusive and highly secretive.

This fund’s success is attributed to its use of quantitative trading strategies. These strategies rely on analyzing data patterns using algorithms to identify market inefficiencies, anomalies, and trends that human traders might not detect. While the exact details of Medallion’s strategies remain a closely guarded secret, experts and analysts have pieced together several possible methods Renaissance employs, which we will explore in the next sections.

Quantitative Trading: The Heart of Renaissance’s Success

At its core, quantitative trading involves the use of mathematical models and algorithms to execute trades based on historical data. Renaissance Technologies relies on quantitative analysis to identify opportunities in the market. This is in stark contrast to traditional hedge funds that may rely on fundamental analysis, human intuition, or market sentiment.

Renaissance’s models are based on a variety of data points, including:

- Market Prices and Volumes: Tracking historical price movements and volume trends to predict future price changes.

- Macroeconomic Data: Incorporating global economic indicators such as GDP growth, inflation rates, and interest rates.

- Alternative Data: Using non-traditional data sources such as satellite imagery, social media sentiment, and even weather data to refine their predictions.

The firm’s reliance on data allows them to spot opportunities and execute trades more efficiently than many human traders, who might be biased or slower in processing the same information.

Key Trading Strategies Used by Renaissance Technologies

While the exact details of Renaissance Technologies’ strategies are unknown, there are several trading strategies they likely employ based on the information we have:

Statistical Arbitrage

One of the likely strategies Renaissance uses is statistical arbitrage. This involves identifying pairs of related stocks or securities that historically have traded in correlation with one another. When these securities temporarily deviate from their usual price relationship, the algorithm buys the undervalued security and sells the overvalued one, profiting when they revert to their typical correlation.

Trend Following

Some experts speculate that Renaissance employs trend-following strategies. These strategies aim to capture profits by buying securities that are trending upwards and selling them before the trend reverses. This approach is common in momentum trading, where past performance is used as an indicator of future performance.

Mean Reversion

Mean reversion is another possible strategy in use. In this approach, Renaissance’s algorithms identify assets that have deviated too far from their historical average and place trades based on the assumption that the price will revert to the mean over time. This approach works well in markets that tend to fluctuate around a stable long-term value.

High-Frequency Trading (HFT)

Renaissance also likely engages in high-frequency trading (HFT). HFT uses algorithms to execute trades within fractions of a second, profiting from tiny price discrepancies that exist for only a brief moment. This approach requires vast computational power, access to massive amounts of data, and low-latency infrastructure.

These strategies, combined with the firm’s cutting-edge technology and research expertise, allow Renaissance Technologies to consistently outperform other funds in the market.

Machine Learning and Artificial Intelligence in Trading

A major component of Renaissance Technologies’ success is likely their use of machine learning and artificial intelligence (AI). These technologies enable RenTech to continuously improve their trading models by learning from new data and refining strategies in real-time.

Machine learning algorithms can:

- Detect patterns that may not be visible to humans.

- Adapt to changing market conditions by learning from previous market behavior.

- Automate the execution of trades, reducing human error and ensuring efficiency.

By employing AI, Renaissance can generate insights from massive amounts of data faster than traditional traders, making decisions at a speed that gives them a competitive edge.

High-Frequency Trading (HFT) and Its Role in Renaissance’s Approach

As mentioned earlier, high-frequency trading (HFT) is likely a significant aspect of Renaissance’s trading strategy. HFT involves the use of advanced algorithms to execute trades in milliseconds, profiting from minuscule price changes that occur in that short window of time.

HFT requires an incredible infrastructure, including low-latency connections to exchanges and powerful computing systems. Renaissance Technologies has the resources and technology to engage in HFT at a scale that very few other firms can match, giving them a unique advantage in markets where speed is essential.

Risk Management and Diversification

Even with their advanced strategies, Renaissance Technologies places a strong emphasis on risk management. In the volatile world of hedge funds, managing risk is essential to maintaining long-term profitability.

Some key risk management techniques Renaissance likely employs include:

- Diversification: Spreading investments across various asset classes, markets, and time horizons reduces the impact of losses in any single position.

- Position Sizing: Renaissance’s algorithms determine the appropriate size for each trade to minimize potential losses.

- Stress Testing: By running simulations and stress tests on their portfolios, Renaissance can understand how their positions would perform in adverse market conditions.

Their ability to manage risk while still delivering impressive returns is one of the reasons Renaissance Technologies has been so successful over the years.

What Makes Renaissance Technologies Different from Other Hedge Funds?

While many hedge funds use quantitative strategies, Renaissance Technologies stands out for several reasons:

- Exclusivity: The Medallion Fund is only open to Renaissance employees, making it one of the most exclusive hedge funds in the world. This allows Renaissance to maintain tight control over its strategies and reduce the risk of them being copied.

- Long-Term Success: Renaissance’s ability to deliver consistent returns over decades, including in challenging market environments, is unparalleled.

- Heavy Use of Science: Renaissance is a pioneer in applying scientific methods, mathematics, and computer science to trading, attracting top talent from academic fields.

- Massive Data Infrastructure: Renaissance has invested heavily in data collection and analysis, giving them access to information that many other funds simply can’t match.

People also search Is Construction Engineering Technology a Good Degree

Can Retail Traders Use Renaissance’s Strategies?

Many retail traders wonder whether they can replicate Renaissance Technologies’ success by using similar strategies. While it’s possible to use some of the same principles, such as trend-following or mean reversion, the reality is that retail traders don’t have access to the same data, computational power, or speed that Renaissance Technologies enjoys.

That said, retail traders can still learn from Renaissance’s focus on:

- Data-Driven Decisions: Base your trades on data and analysis rather than emotions or market sentiment.

- Risk Management: Focus on managing risk by diversifying your portfolio and controlling the size of your positions.

- Continuous Learning: Keep refining your strategies and learning from market behavior.

While you may not replicate Renaissance’s exact strategies, applying similar principles can still lead to success for retail traders.

Conclusion

Renaissance Technologies has achieved legendary status in the hedge fund world, with returns that far surpass traditional investing strategies. Through the use of quantitative trading, machine learning, high-frequency trading, and meticulous risk management, Renaissance has built a system that can consistently identify and capitalize on market opportunities.

While the specific details of their trading strategies remain a closely guarded secret, understanding the core principles behind their success—such as the use of data, technology, and diversification—can offer valuable lessons for anyone interested in quantitative trading.

For those who aspire to achieve success in the markets, Renaissance Technologies’ approach is a reminder that science, mathematics, and technology, when applied effectively, can unlock opportunities that others might miss.